Zillow’s Housing Market Predictions for 2025

As we approach 2025, Zillow, one of the leading real estate platforms in the U.S., has offered its predictions for the housing market, factoring in key economic trends, buyer behavior, and regional dynamics. The company’s forecast highlights both challenges and opportunities for homebuyers, sellers, and investors as they navigate a changing landscape. Here’s a closer look at what Zillow expects for the housing market in 2025.

Continued High Mortgage Rates

Mortgage rates have been a significant driver of the housing market in recent years, and Zillow forecasts that rates will remain elevated through 2025, though at somewhat lower levels compared to the highs seen in 2023 and 2024. Zillow’s experts predict that the Federal Reserve’s actions to combat inflation will keep rates higher than pre-pandemic levels, though they could stabilize slightly over the next few years.

This extended period of relatively high mortgage rates is expected to have a cooling effect on homebuyer demand. Higher monthly payments could discourage some prospective buyers, especially first-time buyers and those seeking larger or more expensive homes. However, Zillow expects demand to remain steady, driven by demographic trends, such as millennials reaching prime homebuying age, and the continued desire for more space and homeownership stability.

Housing Inventory Challenges

Zillow projects that housing supply will continue to be a major challenge for the market in 2025. Despite an increase in construction, the inventory of available homes is expected to remain tight, particularly in high-demand areas. Limited new housing supply, coupled with low existing home inventory, will continue to create an imbalance between supply and demand.

Zillow also predicts that the inventory shortage could push more buyers to consider previously overlooked areas, such as suburban or rural locations, where home prices may be more affordable and inventory may be more abundant.

Home Prices: Stabilization with Regional Variability

While home prices soared in recent years, Zillow forecasts that price growth will stabilize by 2025, with some markets seeing moderate appreciation and others experiencing slower price increases. In highly competitive regions such as large urban centers or desirable suburban areas, home prices are likely to remain higher due to continued demand. However, in areas where affordability challenges have been most pronounced, Zillow expects price growth to slow as higher mortgage rates affect purchasing power.

The market will likely see a more regionalized pattern of price growth, with some areas experiencing price increases driven by strong local economies, job growth, and population influxes, while other regions could see stagnation or even price corrections if demand weakens.

Shifting Buyer Preferences

Zillow predicts that buyer preferences will continue to evolve in 2025, influenced by a variety of factors, including remote work, lifestyle choices, and affordability concerns. The trend toward suburban and rural living is expected to persist, as buyers seek more space, quieter neighborhoods, and better access to nature.

Additionally, Zillow expects more buyers to prioritize homes with features that support remote work, such as home offices, faster internet connectivity, and flexible living spaces. Smart home features and energy-efficient technologies will also become more desirable, as consumers increasingly value sustainability and long-term savings.

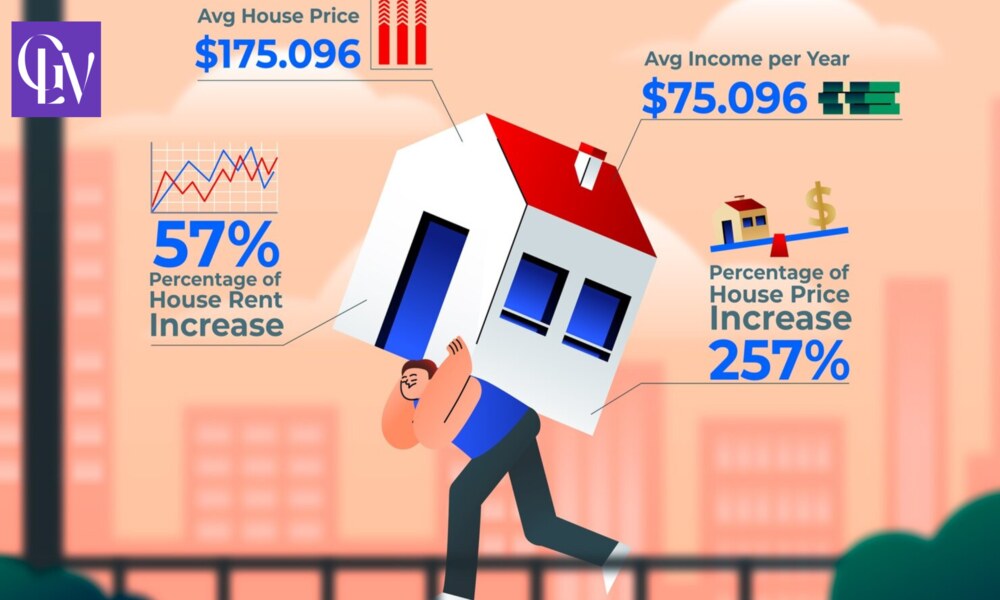

The Rise of Renters and Institutional Investors

Zillow expects the rental market to continue growing in importance as a segment of the real estate landscape. With many first-time buyers being priced out by high home prices and mortgage rates, renting may become the more viable option for many, particularly in urban markets. This shift is likely to fuel demand for rental properties, driving up competition for available units.

Moreover, Zillow anticipates that institutional investors, who have increasingly entered the single-family rental market in recent years, will continue to play a major role in the housing market. These investors, seeking stable returns, are likely to increase their holdings, especially in emerging markets or regions where rents are rising. While this trend could add competition to the rental market, it may also provide more opportunities for renters to find options in a tighter inventory environment.

Impact of Technology and Innovation

Technology will continue to shape the housing market in 2025, with online platforms like Zillow driving efficiencies for buyers and sellers. Zillow’s own role as a tech-driven real estate company will likely grow, offering new tools for buyers to navigate the homebuying process, from virtual tours to streamlined mortgage applications. Additionally, data-driven insights will continue to be a valuable resource for both buyers and sellers in determining home values and market conditions.

Smart home technology, automated home management systems, and energy-efficient appliances are likely to become more common in new constructions and home renovations. Buyers will increasingly seek homes with integrated smart home features that improve convenience, energy efficiency, and security.

Global Leaders View

In 2025, Zillow’s predictions highlight both challenges and opportunities for the housing market. While high mortgage rates and limited inventory will present obstacles for many buyers, demand for homes will remain strong, particularly in suburban and rural areas. Buyers will need to adapt to higher costs and carefully consider their preferences, especially regarding location and home features.

Sellers in desirable markets could continue to see competitive conditions, but those hoping to sell in less competitive regions may face more challenges as buyers become more selective. For investors, rental properties could offer steady returns, but institutional investors will continue to influence the rental market, potentially driving up competition.

Overall, the housing market in 2025 will be one of adaptation, where both buyers and sellers need to plan carefully and take into account shifting economic conditions, consumer preferences, and technological advancements.

Visit Latest Interviews

Recent Posts

Related Articles

Why You Should Think About Your Domain Extension Before You Think About The Name?

Think of your domain extension like a surname—it wraps up your web...

ByGlobal Leaders ViewAugust 19, 2025Germany’s ‘Energiewende’ Initiative: A Vision for a Sustainable Future

Germany’s ambitious energy transition, known as the Energiewende, aims to shift the...

ByGlobal Leaders ViewJanuary 27, 2025Global Platform on Sustainable Cities Established

In a groundbreaking move toward addressing the challenges of urbanization and climate...

ByGlobal Leaders ViewJanuary 27, 2025Singapore’s Green Urbanism Initiatives

Singapore, known for its modern skyline and bustling urban environment, is also...

ByGlobal Leaders ViewJanuary 27, 2025

Leave a comment